Hello there, in this blog post, we are going to discuss why will 2023 be a big year for custom insurance software. So keep reading.

Today’s culture is plagued with persistent problems that impact our relationships with others, both in and out of the workplace. For instance, the global economic climate was severely affected by COVID-19, leading to the closure of several businesses.

Large sums of money can be insured to protect businesses, employees, and assets from medical and financial dangers. Because of this, the need for insurance administration software has increased rapidly in recent years.

Furthermore, many up-and-coming organizations and entrepreneurs draw motivation from the successes of well-established custom software development company in Dubai to launch their unique insurance systems.

However, many people still need to figure out how to launch their venture profitably. Additional services like Blockchain Development Company may increase the price. The following is a breakdown of some of the higher costs of creating a mobile app in Dubai.

As a result, we have created a detailed guide on creating software tailored to the insurance industry, which covers the following topics:

- Definitions of the Major Types of Insurance

- The State of the Insurance Software Industry

- The fundamental capabilities of insurance-related technologies

- The fundamentals of creating insurance-related software as a service

Have fun, and first, let’s define the term.

Explaining InsurTech and Its Major Subcategories

In the same way that “PropTech” defines the groundbreaking convergence of real estate and technology to satisfy market needs, “InsurTech” does the same for the insurance industry. The term “insurtech” is used to describe the development of software for the insurance sector to automate mundane processes, lower costs, increase customer happiness, and increase productivity.

Now that we know dozens of software categories, we may investigate what software insurance companies utilize.

Management Tools For Insurance Documents

This type of solution aims to make it easier and faster for insurance companies to locate relevant data. Policyholder agreements, customer proofs, policy applications, and contracts are common forms brokers use in their transactions with insured clients.

Systems For Automating The Insurance Industry

This type of software solution is crucial to the success of insurance firms because it automates and streamlines common processes across departments, including sales, marketing, lead management, human resources, customer service, and more.

When you think about the hundreds of multi-component interactions that insurance companies deal with daily, you’ll see why insurance automation software is so important.

Management Software For Insurance Policies

Insurance agencies must produce, process, personalize, and administer consumer insurance policies. The policy management software offered by insurtech companies helps businesses lower insurance risks and streamline reinsurance processes by automating facultative arrangements and reinsurance treaties.

Software For Underwriting and Grading Insurance Policies

Insurance companies take on a certain amount of financial risk when insuring clients’ houses, automobiles, health, and other belongings. Software for underwriting and rating insurance policies streamlines and clarifies the underwriting process; allowing employees more time for strategic planning and execution.

Insurers need the creation of rules and regulations that instruct the software to carry out the necessary operations automatically. At this point, we can eliminate human error and cumbersome manual procedures.

Claims Processing Software For Insurers

Insurers can use this digital technology to streamline the processes of policy management, claim verification, payment processing, and more. By automatically processing massive volumes of accurate data securely, identifying fraudulent claims, and collecting early signals of loss, insurance claims software helps businesses save money in the long run.

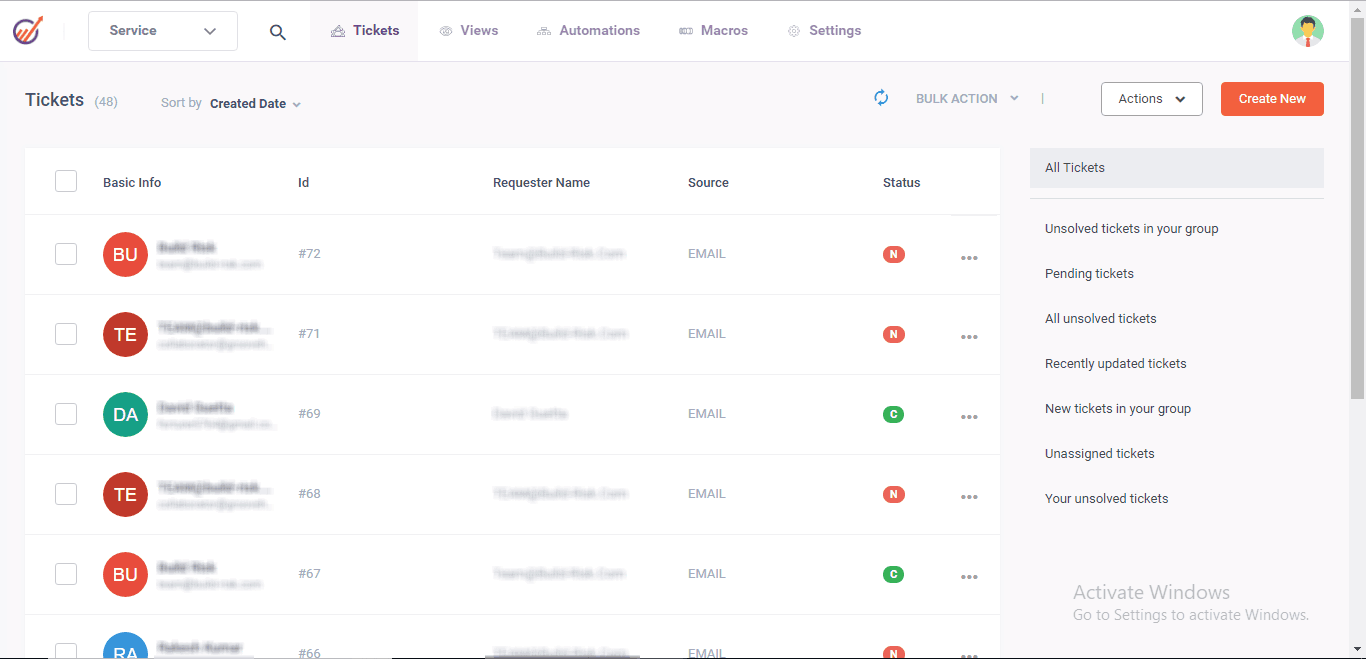

Insurer Customer Relationship Management Systems

Lead generation, customer service, and marketing strategy adjustments are all essential in the insurance business, as in any other. When compared to other types of organizations, insurance agencies are exceptional in the amount of sensitive data they collect, store, retrieve, process, and transmit.

As a result, insurance brokers and their clients can meet in safe virtual environments where sensitive information can be exchanged, policies can be signed electronically, and digital payments can be made with peace of mind.

Calculating Premiums For Insurance

Insurance firms can save time and energy by quoting software to streamline their negotiations with prospective customers and current policyholders. Using this template, firms can construct custom, win-win bargaining scenarios. The days of insurers interacting with thousands of prospective clients over the phone or in-person to review policy details and compensation projections are long gone.

On the other hand, insurance quote software automates the entire process with only a single tweak to the settings and adding a link to a mobile app or web form.

The Value of Insurance-Specific Software

Here, we’ll review a few of the main advantages cloud-based software can provide to your insurance agency.

1. Lower Running Expenses

The best insurance software can shorten the time to reach agreements and prevent crucial documents from missing. Spend less on administrative costs while increasing output and decreasing human-error-related mistakes by automating routine manual chores.

2. Strengthen Your Compliance Administration

With unique insurance business software with a built-in compliance protocol, your insurance company can adjust to the ever-changing regulatory landscape. Compliance management can prevent time-consuming and expensive manual course corrections and error resolutions.

You can rest assured that all of your sales funnel’s procedures will run thanks smoothly to this software.

3. Improving Third-Party Interactions

As was previously mentioned, insurance quoting software facilitates the delivery of fast; pre-made quotes in response to questions from prospective consumers and existing clients. This saves time for both parties, which is great for providing excellent service and encouraging repeat business.

Opportunity management options abound in insurance CRM software, allowing you to promptly provide your clients with the care they need. A clear view of customer behavior and the ability to automatically send upsell and cross-sell signals to sales representatives and brokers is a huge benefit of customer relationship management software in the insurance sector.

4. Use Reporting and Analytics Tools for Forecasting

In-depth data analysis is crucial for any insurance firm to measure the efficiency of their teams and make decisions based on facts. Now more than ever, insurance software developers are using AI algorithms and ML neural networks to fuel predictive smart insurance analytics applications.

Based on the analysis of the massive volumes of data created by your company’s day-to-day activities, high-probability analytics are developed for internal and external users. Companies can transform the raw data into visually appealing reports rich in information, and insurance agencies can make predictions quickly using the software.

5. Improve The Precision of Data

Due to the potential for large financial losses and high customer turnover rates; all data used in the insurance sector must be as accurate as possible during collection, processing, and delivery. As a result, your insurance company must use cloud-based software that provides robust methods for verifying data integrity.

Common business processes that necessitate data accuracy authentication include system audits, address converters, payment verification systems, and policy data development. Moreover, insurance fraud software can streamline investigations by identifying fraudulent claims automatically using artificial intelligence algorithms and RPA (Robotic Process Automation) technology.

Conclusion: Custom Insurance Software

The importance of digitization is wider than just the insurance sector. The performance of organizations is the first target for change. The advent of innovative software in the insurance industry could lead to significant savings, greater output, less stress, and the acquisition of new clients. When added together, these benefits boost the value of the business. Custom insurance software positions the insurance firm as the most efficient and reliable option for policyholders and new consumers.